The Week: DAOs, worthless gamer money, and BaceFook

Plus: at least a few low-effort links

Welcome to this week’s free edition of The Terminal. If you’re not a subscriber and you’d like to be, click below.

Decentralised Australian Organisations

A bipartisan Senate committee named the Select Committee on Australia as a Technology and Financial Centre handed down a report this week laying out a plan to provide regulatory clarity on cryptocurrency and situate Australia at the centre of the future digital economy.

It’s worth a read, and mostly makes the kind of suggestions you would expect: developing fit-for-purpose taxation and incentive structures, setting up token licensing regimes, providing recourse for crypto businesses that struggle to partner with local banks, and so on.

But one recommendation, which the AFR described as ‘eye-popping’, is particularly worthy of note. Recommendation 4 is as follows:

The committee recommends that the Australian Government establish a new Decentralised Autonomous Organisation company structure.

A ‘decentralised autonomous organisation’ (DAO) is an entity with no central leadership which is collectively owned and governed by a community around a set of rules on the blockchain. Those with a stake, established by ownership of a certain crypto token, participate in the governance and vote on new protocols, which are executed with blockchain smart contracts.

The report correctly indicates that DAOs “do not clearly fall within any of Australia's existing company structures” and proposes that a structure be established, regulated by the Treasury, that would limit liability for token holders and allow DAO governors to hire people and engage in employment relations IRL.

This is not totally unheard of — Wyoming, which is pitching itself as as a crypto jurisdiction, legislated in this area earlier this year. But it’s still pretty wild that this is being countenanced.

A rose by any other name

Facebook is set to change its company name next week. Varying evidence points to it being called either Horizon or Meta, but it might be neither of those things — as of Wednesday, Casey Newton at Platformer reported that the company hadn’t actually settled on a name yet.

This is all ostensibly part of Facebook’s pivot towards building the ‘metaverse’: that squishy concept of always-on human-computer interface where all of our economic, social and human interaction are mediated by some persistent digital world. Zuckerberg has been talking about the metaverse non-stop over the past few months, and its obvious he sees that as more important than the core Facebook products as they currently stand. (See also: the PR stories about how many people they plan to hire to build it out.)

Obvious parallels are drawn with Google changing the name of its holding company to Alphabet, but it’s really more like Phillip Morris rebranding as Altria. I think it’s pretty obvious by now no one would touch the ‘Facebook Metaverse’ with a ten-foot pole, in much the same way as nobody wants Facebook’s mostly pretty anodyne video chat hub. It’s a poisoned well. The brand is torched. The company will now leave the main Facebook app and the attendant branding as a doomed boomer purgatory, while it corrals its enormous resources to try and build something more enduring under a new name.

Relatedly, this story from the New York Times about Facebook’s existential fear that it is losing young users – i.e. the next generation of ad audiences with disposable income — even on Instagram:

In a meeting last month, they said, executives pored over data showing that a bump in new teenage users during the pandemic was ending. “Teen time spent,” a term denoting how many hours a day teenagers are on Instagram, also dipped. That was alarming because Instagram relied on teenagers to spend an average of three to four hours a day on the app, nearly double what adults spend on it, they said.

Spare a coin, sah?

One of the big weird online stories this week is about Amazon’s first successful gaming project, the massively-multiplayer online RPG New World. There are plenty of reports, spurred by a blog on Player Auctions, suggesting that the in-game economy is suffering from a deflationary currency crisis.

In short, the game does not give players enough opportunities to earn currency. Rewards from normal RPG tasks like killing monsters and completing quests are too low, meaning players are hoarding their coin rather than spending it:

As a result, prices have been dropping for goods, particularly crafting materials such as ore, not necessarily because there isn’t enough coin to afford them, but because the value of the currency is so much higher than the value of goods, given their relative scarcity. A punishing overhead “tax” burden exists in the game, where the cost for crafting, home-ownership, or repairs exceeds the players’ ability to accumulate coin. In addition, companies are taxed for territory ownership, essentially disincentivizing [player vs player combat] since the marginal costs far exceed any potential benefits.

Currency is so valuable now, that on certain servers, direct trades have become part and parcel of a make-shift barter economy, with neither party willing to part from coin.

This is actually the opposite problem usually faced by currencies in other online multiplayer games, which inevitably face inflationary pressure as players build huge fortunes without places to spend it. In-game money generally appears from the ether in these sorts of online worlds without much by way of monetary controls, and the only way to control the effects of unlimited supply is to give players something to spend it on (“sinks”). Without somewhere to dispense these enormous fortunes, in-game prices inevitably increase. Long-running MMO Star Trek Online faced this problem a few months ago, which led to the collapse of an in-game resources exchange.

(As this tweet pointed out, you can also think about the New World problem in Keynesian terms as a liquidity trap — a situation in which “almost everyone prefers cash to holding a debt which yields so low a rate of interest.”)

Multiplayer game economics is always funny in an abstract kind of way, as examples of how broader systems and trends are replicated inside digital worlds. But this morning I was listening to a podcast about increasingly popular NFT game Axie Infinity — which synthesises gaming incentives with real-world money using cryptocurrency and tokens — and I got the overwhelming sense that the delineation between real and ‘pretend’ economies is only going to become less and less relevant.

Monkey/beans interlude

TrumpNet

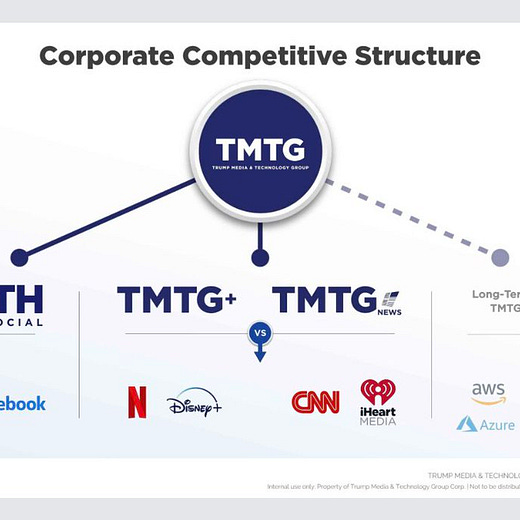

The long-awaited Trump social network is finally here. TRUTH Social, while not really much different in execution to the other legion of conservative-focused free speech platforms that have emerged and then collapsed, is funny in that it is pitching itself as part of a broader programme called the Trump Media & Technology Group, which has an incredible pitch deck:

It’s a bold vision for a parallel, anti-censorship conservative online economy which tackles entertainment, social networking and even basic tech provision and a cloud hosting layer. I hope you’re all excited to process your payments through some kind of Trump-branded, anti-woke Stripe clone.

There’s some inherent conflict there with the other right-wing challengers to Big Tech. GETTR, founded by long-time Trump adviser Jason Miller, seems to be spiralling in response to the announcement. Despite a livestream arguing that this was all great for the movement (and terrible news for Facebook and Twitter), there seems to be a general, unvoiced understanding that the world can’t handle that many conservative Twitter and Facebook competitors — in much the same way as it doesn’t seem able to handle many Twitter and Facebook competitors full stop.

This is the question I’ve never seen cohesively answered by anyone trying to create ideological competitors to tech behemoths. Social networks are beneficiaries of the most comprehensible network effect imaginable: the more people who use them, the more useful they are1. If you want to connect with all your friends, you’ll go to the platform where all your friends are. If you want to follow celebrities and news, you go to the platform where they all post. If all your friends are conservative free speech absolutists, then you might find them all on GETTR. If they’re all passionate Trump fans, you might find them on TRUTH Social. But they’re the only people you’d find. It’s an internet forum with a new paint job. Which is fine: internet forums can be great. But it doesn’t really serve the same role.

Assume for a moment one of these platforms actually managed to break through and become big enough to be effective challengers to Big Tech. Two billion people were on GETTR, let’s say. There’s absolutely no way it remains a bastion of free speech, sorry. Communities of that size require a constant negotiation of interests, solid guardrails and a high level of moderation to make it a worthwhile place to be. It’s pretty easy to argue that Twitter and Facebook both fail hugely in their efforts to do this, but a free-speech maximalist model for either company probably wouldn’t work either, on a purely functional level.

Anyway, it’s all off to a good start:

Elsewhere

This piece on the economics of instant hyper-local delivery in the US caught my eye, especially as I see companies like Milkrun pop up in Sydney.

I occasionally read the celebrity blind item blog Crazy Days and Nights because I like peering into its often unhinged vision of a Gomorrah-esque liberal Hollywood where everyone is either a drug-fucked zombie or engaged in sex trafficking. This bit in BuzzFeed sort of explicates the weird, QAnon-adjacent vibe of it all, which has only gotten more intense recently.

This bit in Foreign Affairs about how tech companies act like states in the new global order. It goes a bit deeper than the usual surface-level read on that angle.

A prominent investor in NFT gaming projects like the aforementioned Axie Infinity raised $65 million at a $2.2 billion valuation. There’s a lot of money ping-ponging around in this world right now.

Thought this was good on the logistics of returning products — especially clothing — in the world of online shopping.

An interview on social science and its ongoing replication crisis.

Another piece on the “burst of the rideshare bubble”.

This story about great white sharks on Cape Cod.

Good: “My Father, The Hitman”.

Of course, the size of the community can also be a huge social detriment, but I mean purely in terms of attracting new users and engagement.