The Week: Afterpay + Square, South Park, and cyberpunk

Plus this week's reading list

Hi folks.

I’m rechristening my weekly reading list as more of a weekly wrap, featuring not just what I’ve been reading, but also bits and pieces from the week and a some commentary. Shorter thoughts that I probably won’t give their own newsletter. So, more or less exactly the same as what it has been the past couple of weeks, just advertised better.

As always, feedback is welcome, and you can subscribe below if you’re not on the list:

Square and Afterpay

I might do a longer post about the Afterpay-Square deal at some point, and I also have a story coming up this weekend in The Saturday Paper giving a bird’s eye view of the whole situation.

But anyway. When I wrote in June about the legion of buy now, pay later clones springing up and starting to colonise other frontiers of consumer finance, I expressed vague doubt that the whole thing was sustainable, with potential interest rate rises looming somewhere on the horizon and threatening the whole model, and the prospect of tech behemoths like PayPal and Apple sniffing around for an entry.

If you ask me, I think this is Afterpay acknowledging that its chances outside a larger payments ecosystem are potentially a bit dicey. In this respect, it’s a nice deal for both parties: Square gets a best-in-class, already scaled-up BNPL product and all of Afterpay’s customers into its own Cash App (where it can sell them on all sorts of other stuff), and Afterpay gets a moat between it and its enormous new rivals, plus access to millions of Square merchants.

$AU39 billion is a lot of cheese to pay for that. It works out to be about 26 times next year's sales. It suggests that Square, which will inevitably be one of the big dogs of the next decade or so of payments, is making a huge bet that BNPL is the way consumer finance is going to look going forward.

What I’m most interested in is whether, once BNPL is dominated by a handful of massive corporates — many of which are the same corporates which dominate the rest of modern life — it starts getting treated a bit more seriously by regulators, who have been happy to let the sector boil over until now on the basis that they don’t want to stifle innovation. A NAB report from June said a quarter of Australians aged fifty and under were holders of BNPL debt in the first quarter of 2021, many from multiple providers. Might be worth looking at!

Respect mah authoritah

There was a period in the culture where something would happen and then South Park would quickly parody it, absorbing the event into a soft-libertarian worldview that was very in vogue at the beginning of the millennium. This boom-bust parody cycle happens a lot quicker online now, but South Park is rarely involved. I honestly can’t remember the last time it happened, and to be honest I had no idea the show was still releasing new episodes.

Nevertheless, there’s this:

The creators of “South Park” have signed a new deal with ViacomCBS Inc. that will pay them more than $900 million over the next six years, one of the richest deals in TV history.

Trey Parker and Matt Stone will use the money to make new episodes of “South Park” for Viacom’s Comedy Central network and to create several spinoff movies for the company’s Paramount+ streaming service, the parties said Thursday. Their first project under the new deal will be a movie set in the world of “South Park” that will debut some time before the end of the year.

Hollywood has always taken a pretty mercenary approach to intellectual property, which has obviously approached fever pitch over the past decade in no small part because of hugely successful efforts like Marvel, which meant that suddenly everybody needed a ‘universe’ to build off. The streaming wars are amplifying this further, with every skerrick of IP bled dry across multiple formats.

There’s a whole lot of content around these days, you’ve probably noticed. Between Netflix’s commitment to releasing a new movie at least every week and the Disney/HBO Max/Paramount+/Apple TV/Amazon/etc hydra’s drive to wring every last drop out of every single property means we’ve never had more to watch, and yet very little of it is particularly good. Troves of viewing data mean that producers know with near-certainty what people will reliably watch, and make content to maximise those eyeballs. It’s entertainment by way of machine logic, and the only thing to anchor people to something truly longstanding is with intellectual property they already know, from before we did things like this. Hence South Park.

In short, Peak Content is one of the things that make me think Francis Fukuyama was probably onto something:

Japanese dream

I just reread William Gibson’s Neuromancer, which I haven’t picked up since I was a teenager. This is not a particularly original thought, but it’s interesting how a lot of cyberpunk and general science fiction of the late seventies through the early nineties is informed by the assumption the the future belonged to Japan. When you said ‘the Asian century’, you probably meant Japan.

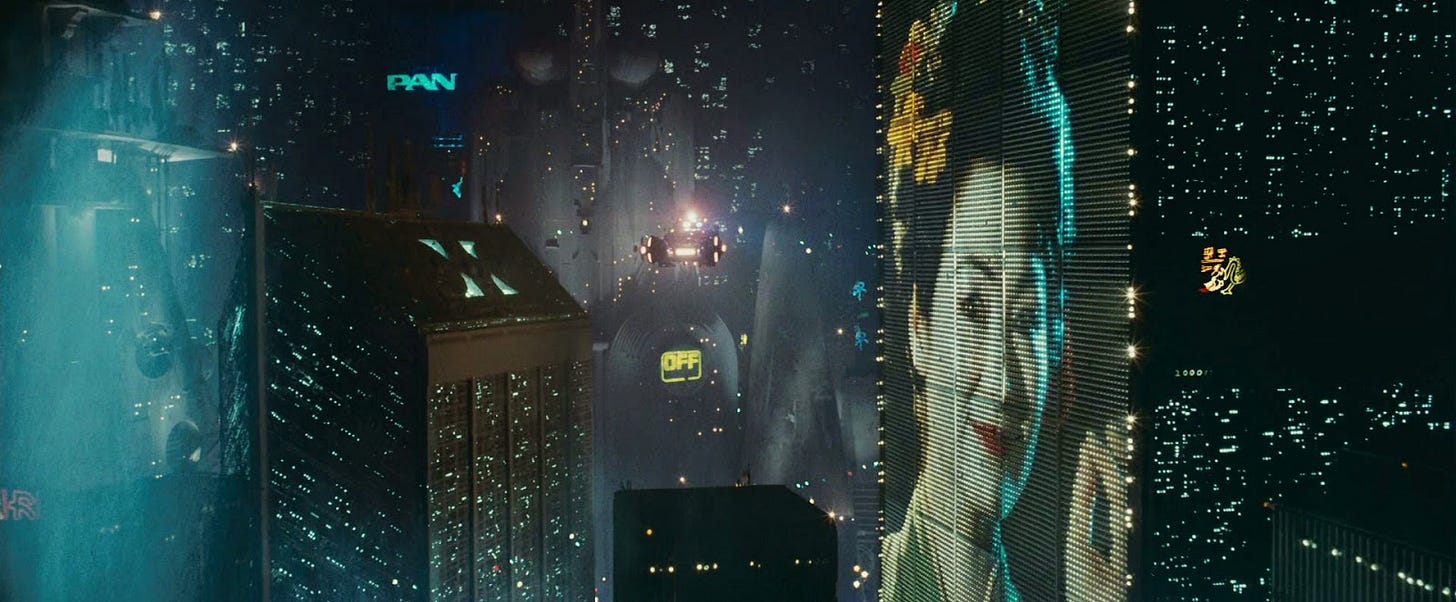

In Neuromancer, aside from the general Japanese vibe of the future world, there are plenty of little nuggets, like foreboding references to a company named “Mitsubishi Bank of America”. (Alien also played on this nascent fear with the company Weyland-Yutani.) Blade Runner is often referenced in this context too, with the empty, funereal Los Angeles of Philip K. Dick’s short story replaced with the bustling quasi-Japanese metropolis of Ridley Scott’s vision1.

(You can also see the latter phases of this period in my favourite forgotten Australian political scandal, the Multifunction Polis, which critics thought was going to be some kind of lawless high-tech Japanese colonial outpost north of Adelaide rather than a largely benign business park.)

Of course, none of this actually eventuated, as Japan was eventually hamstrung by economic stagnation and an ageing population through the nineties and beyond. But it’s funny to see how those strange anxieties persist in the culture, often with China crammed into the same broadly East Asian iconography.

The video game Cyberpunk 2077, which doesn’t really pretend to be anything more than total genre pastiche, is so invested in the techno-Japanese aesthetic that it feels paradoxically old and tired.

This week’s links

Last month Jeffrey Burrill, the general secretary of the United States Conference of Catholic Bishops and one of America’s top clergymen, was outed as a frequent user of Grindr and patron of gay bars. This was purportedly discovered by some Catholic rag using geolocation data. This post goes into great technical detail about how this might have happened.

Fun read on pedestrianism, the antecedent of racewalking (one of my favourite Olympic sports):

The rules were simple – essentially, contestants were required to walk in circles for six days in a row, until they had completed laps equivalent to at least 450 miles (724km). They could run, amble, stagger or crawl, but they must not leave the oval-shaped sawdust track until the race was over. Instead they ate, drank and napped (and presumably, performed other bodily functions) in little tents at the side, some of which were elaborately furnished.

I don’t know a whole lot about Islamic finance so I found this ABC story about providers in Australia to be very interesting.

Enjoyed season two of the Blowback podcast, which charts the course of the US covert war on Cuba, starting with the revolution.

A good Weird Australia read in this NYT writeup of the disappearances in the Wonnangatta Valley.

Blade Runner 2049 tried to update this somewhat for a new age, with much of the Los Angeles skyline looking more like crowded Hong Kong apartment towers than glittering neon skyscrapers.