The Week: the future of crypto, Afghanistan's central bankers, and why search sucks

And some links, because you're obviously not doing anything else

Happy Friday, and welcome to your weekly free post from The Terminal. Here’s what I’ve published in the past week for both free and paid subscribers.

A short essay about the ‘metaverse’ and Mark Zuckerberg’s lame virtual reality pitch to the white collar masses. [free]

You can subscribe below, if you’re keen for more. As I announced last week, you can get extra content from The Terminal for $7 a month or $70 a year.

Crypto and grey technology

This was a smart blog from Steve Randy Waldman about where the crypto world might be going. In short, he thinks that cryptocurrency and the blockchain as we understand it are largely transitional technologies, and something will emerge from the negotiation between the upstarts and the existing regime:

In the end, I think crypto will be one of many examples of what I’ll call a “grey technology”. A grey technology starts out, often self-consciously, as a revolution and an underdog, an antagonist to an existing industry and regulatory regime. Via some combination of stealth, pretension of technological ungovernability, and aggressive self-righteousness, early proponents launch projects that demonstrate the value of practices that the existing regulatory regime would discourage or forbid. However, the result is not overthrow or irrelevance of the regulatory state, but a process of conflict and negotiation between the upstarts, incumbents organized around the status quo regime, and regulators. Eventually a new equilibrium emerges that either embraces some of the once discouraged practices, or enables alternative means of producing the newly demonstrated value without the troublesome practices.

One of the reasons I started this newsletter is I want to try to understand where we’re overindexing on the impact of technology, and where we’re underindexing. We’re in a period of significant social and political flux at the same time we’re seeing rapid (or seemingly rapid) advances in technology and networking, and sometimes it can be challenging to identify what influences what.

Crypto is one of those subjects which seems divided between the evangelists and skeptics. Navigating the conversation on social media, you’ll see mostly people who think it’s going to completely change the world and those who think it’s a cynical Ponzi scheme, with profiteers and the financial cognoscenti doing their respective thing somewhere in the middle.

I wrote earlier in the year during the first NFT boom that the crypto economy was like “a shadow world encroaching on our reality”. Waldman I think articulates well how that shadow world might unite with our own. As central banks consider their own digital currencies and DeFi continues to develop in background, I think those in the skeptic camp should be thinking about how their politics might operate in this new world.

Search sucks!

This thread is among plenty I’ve seen recently articulating the same point: using search absolutely sucks now, and obliterates the possibility of finding anything remotely interesting online.

Yes, Google is the main perpetrator, but the alternatives are not immensely better — even on noble alternatives like DuckDuckGo a simple search will often return a wall of of SEO-optimised chum, index pages and recent content from major news sites. That’s because the internet has irrevocably changed to conform to the rules of search engine optimisation, and your only hope for getting a blog or a unique perspective off the ground is to flog it on a social or video platform.

The new model of the non-social internet is purely utilitarian: you search for something and you get an answer. There are 5 million near-identical pages jostling to give you that answer, and sometimes Google (or whoever) will deign to scrape the answer from one of the more reputable ones and put it up the top of the search results so you don’t need to click anything else.

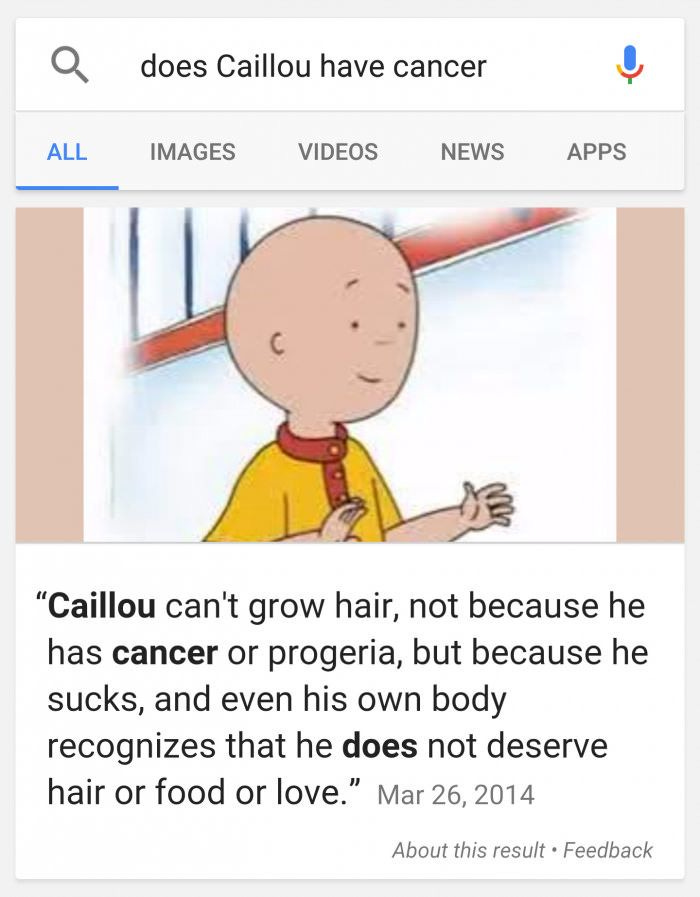

It kind of works. But chasing that algorithm leaves us little room to do anything interesting. At least the knowledge graph occasionally produces amusing artefacts, like this classic:

A central banker in Kabul

An interesting interview on the ‘Odd Lots’ podcast with Ajmal Ahmady, who was the acting governor of Afghanistan’s central bank prior to the Taliban retaking the country.

I don’t even want to speculate how spooked up and deep statey this Harvard-educated former World Bank guy probably is — he spends a decent chunk of the interview refusing to drop names of various people he was in meetings with during the crisis for ‘political’ reasons — but it’s nevertheless an interesting look at attempts to build a sustainable financial system and things like payments infrastructure in Afghanistan. Also features some speculation on what the Taliban’s macroeconomic policy might look like and the economic problems they’ll inevitably run into. (The group has since announced an “obscure official” named Mohammad Idris as their central banker.)

Of particular note was Ahmady’s digression on opium exports, which are obviously a significant part of Afghanistan’s economy and inevitably show up on the state’s balance sheets (and were taxed by the Taliban in the provinces they controlled). Here’s a transcript of that exchange, just because I found it interesting:

I kind of have to ask maybe a sensitive question. But what role does opium play in the economy? Because I cannot imagine that drug proceeds show up as exports in the current account. And yet most people would say that they are an important, although not necessarily desirable part of the economy.

So I think they finance a portion of the current account deficit. If you take a look at opium … I believe the recent UNODC report states there's about 200,000 hectares of opium produced, each hectare produces about 27 kilograms, and the price is about two hundred. So when you multiply all this together, it ends up being roughly about a billion dollars in receipts. And when you take a look at our current account deficit – ex aid, because aid is included in it – the trade deficit we can say is roughly around $7 billion. We auction off for providing liquidity around $2.5 billion or $3 billion. So there is a significant part of current account deficit – which is also being financed through other means – but there's obviously a portion that's probably being financed through opium receipts, though we don’t have that data.

OnlyBans: Redux

OnlyFans walked back its porn ban:

Ahead of the reversal, founder Tim Stokely was interviewed by the Financial Times, where he specifically blamed BNY Mellon, Metro Bank, and JPMorgan Chase as the financial institutions which “flagged and rejected” payments to OnlyFans. He rejected some speculation — including by me last week — that Mastercard had anything to do with it. (This is despite the fact Mastercard’s enhanced requirements for adult content kick in on October 15, two weeks after the porn ban was supposed to begin.)

OnlyFans executives told the FT that “larger financial institutions” came to the table after Stokely’s initial comments and amid “wider pressure and criticism” on banks. Thus, they could hash out a deal.

I dunno, feels like there’s a lot unsaid here which I imagine will come out at some point. Predictably, there is a lot of uneasiness from sex workers about the company, which should be the default position.

This week’s reading

Just finished ‘Energy’ by Richard Rhodes, which is a very digestible history of the world’s energy transitions and the people who made them happen. Recommended if you’re into that sort of thing. I listened to it on audiobook, and the narrator insists on doing dogshit accents for all the (plentiful) quotes. So you’ll either love or hate that.

Good story from Platformer today, which digs deeper into Facebook’s widely viewed content report. In short: everything popular on FB is low-quality plagiarised garbage — something that often gets lost in the conversation about vaccines and misinformation and what have you. (I wrote a bit about this for paid subscribers this week.)

I’ve written about the link in bio world before. Here’s a look at what Linktree, one of the biggest players in the space, wants to do.

This great history of why Google has repeatedly failed to make a messaging app that people actually use.

Interesting bit from Business Insider [$] about Gimlet, and how its not performing as well as some of Spotify’s other headline-making podcast network acquisitions.

Loved this essay in Gawker about John le Carré’s George and Ann Smiley, “one of the strangest marriages in fiction.”

I didn’t get a chance to watch much of the Melbourne International Film Festival despite it going online due to Covid, but I did watch “Woodlands Dark and Days Bewitched: A History of Folk Horror”, which was excellent. A really great, comprehensive dive into a genre I love, including its Australian expressions. Highly recommended if it gets distribution where you are.

Interesting read on crypto and blockchain, particularly the last three paragraphs. We are definitely seeing a push from Blockchain Australia (et al) and some Parliamentarians (seemingly led by Andrew Bragg) for greater regulatory clarity around "virtual assets". I still feel that the precise nature of the regulatory certainty they are looking for needs greater definition but we are definitely seeing attempts from industry players to regulate their way into the mainstream. At the same time, we also seem to be witnessing a subtle shift in advocacy to de-emphasise the importance of decentralised governance as a blockchain function.

Finally, I wonder if the relative level of regulatory oversight is significant? The financial sector is subject to far more onerous regulation than anything faced by Napster, Uber or AirBNB.